Attention

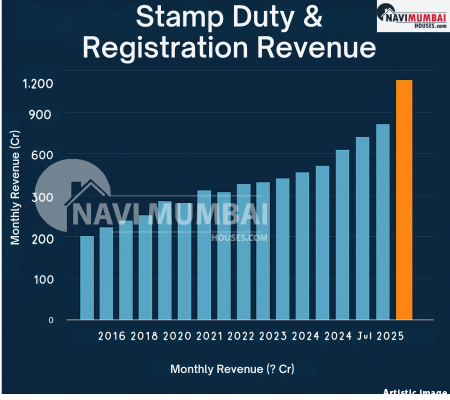

In July 2025, Mumbai’s real estate market achieved a milestone: ₹1,101 crore in stamp duty/registration revenue from property registrations—its highest in over a decade.

That isn’t just a number. It’s a signal. It suggests renewed buyer confidence, rising ticket sizes, and real momentum in a market long viewed as saturated and sluggish. For homebuyers and developers alike, this breaking of the 11-year record is far more than a headline—it’s a potential pivot point.

Interest — What Drove This Surge?

1. Volume + Value Mix

Mumbai recorded 12,366 property registrations in July 2025. That includes both affordable and high-value properties.

Interestingly, while smaller homes continue to be popular (especially sub-1,000 sq ft ones), the share of large, luxury properties has risen. The ₹5 crore+ property segment’s share edged up from 5% to 6% year-over-year, translating to substantially higher stamp duty collections.

This suggests that it is not just quantity but value escalation pushing revenue.

2. Buyer Confidence & Credit Conditions

Interest rates, home loan availability, and macroeconomic stability often influence buyer behavior. In 2025, lower borrowing costs or improved sentiment may have encouraged buyers to pull the trigger on bigger homes or investments, contributing to higher revenue.

3. Supply Response & Developer Activity

Developers launching projects, especially in emerging nodes or suburbs, likely offered deals and inventory that matched buyer interest. The renewed activity may have brought more transactions within the registration net, especially in outer areas.

Desire — What It Means for Homebuyers & Developers

This record has multiple ripple effects.

For Homebuyers & End Users

For Homebuyers & End Users

-

Better negotiation & leverage: In markets with momentum, buyers may find more options and competition among developers, giving more room to negotiate on extras (parking, interiors, furnishings).

-

FOMO & urgency: When markets hit records, many hesitant buyers step in, fearing price escalation. If you were waiting, the moment is real.

-

Cautious optimism needed: Not all nodes or projects benefit equally. Premium zones and well-connected suburbs often lead, while remote areas lag.

For Developers / Sellers

For Developers / Sellers

-

Pricing power: This kind of revenue means there is buyer willingness to pay for premium features, amenities, and well-located projects.

-

Higher land/plot valuations: As stamp duty revenue rises, circle rates and ready reckoner values may be adjusted upward, pushing future land costs higher.

-

More launches & risk appetite: Developers may accelerate breaking ground on new projects, especially in nodes historically undervalued.

-

Focus on quality & differentiation: To justify premium rates, developers must offer more green features, smart homes, sustainable design, and transit access.

Action — What You Should Do Next

If you’re a buyer / investor:

-

Shortlist nodes with growth momentum

Look at suburbs, outskirts, nodes with infrastructure projects—metro, expressways, airport links. -

Track circle rate / ready reckoner updates

Stamp duty revenue surge may trigger revisions. That can affect both purchase cost and long-term tax impact. -

Time your acquisitions

If you act now, you may ride the upward wave before prices move further upward. -

Assess developer credibility & delivery track record

In a strong market, many developers will claim association. Scrutinize quality, reputation, and timelines.

If you’re a developer / builder:

-

Capitalize with intelligent launches

Projects catering to mid + premium segments in areas with improving connectivity may outperform. -

Leverage buyer sentiment in marketing

Use this revenue story as proof of demand; justify premium pricing with strong value proposition. -

Manage land cost escalation risk

As land becomes more expensive, keep profit margins realistic; avoid over-leveraging. -

Focus on non-price differentiation

Amenities, smart features, environment credentials, maintenance, and connectivity will matter more.

Conclusion

Conclusion

Mumbai’s real estate market in July 2025 didn’t just produce another strong showing—it broke an 11-year revenue record with ₹1,101 crore in property registration collections.

For homebuyers and developers, this is a signal—of confidence, buyer willingness to pay, and a possible turning point in price dynamics. But it’s also a moment to act wisely. Those who align with infrastructure, choose credible developers, and time their entry or launch carefully stand to benefit most in the evolving Mumbai real estate landscape.

Visit or Contact us : +91 8433959100 or www,navimumbaihouses.com

The post Mumbai’s Real Estate Boom: The ₹1,101 Cr Stamp Duty Month & What Lies Ahead appeared first on .