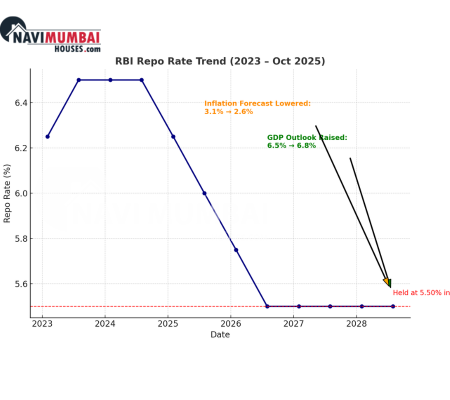

In its October 2025 meeting, the Reserve Bank of India (RBI) opted to keep the repo rate unchanged at 5.50%, instead of raising or cutting it. At the same time, it surprised many by upgrading India’s GDP growth forecast to 6.8% (from 6.5%) and lowering inflation guidance to 2.6% (from 3.1%) for the fiscal year.

This combination—a rate hold with brighter growth expectations—marks a subtle but meaningful shift in RBI’s stance.

Why RBI Held Rates & Why Growth Looks Better

Reasons Behind Holding Rates

-

Inflation Is Moderating

RBI has observed softening price pressures. The revised inflation forecast of 2.6% suggests ample room before inflation becomes a concern. -

Policy Cuts Already in Place

Earlier in 2025, the RBI had delivered cumulative rate cuts totaling 100 basis points, from 6.50% down to 5.50%.

The central bank may be giving these cuts time to permeate the economy before making further moves. -

Global & Trade Headwinds

Risks from U.S. tariffs, global supply chain disruptions, and external demand fluctuations remain. RBI is cautious not to overreact. -

Neutral Stance & Policy Space

The RBI has retained its “neutral” policy stance, signaling it is neither leaning hawkish nor dovish—keeping options open for a future cut if conditions allow.

Why Growth Outlook Has Brightened

-

Resilient Domestic Demand

Consumption and investment have held up better than anticipated, supporting optimism in economic expansion. -

Favorable External Balance

The current account deficit (CAD) narrowed to 0.2% of GDP in Q1 FY26 from 0.9% a year ago, reducing external sector pressures. -

Lower Inflation & Real Income Relief

With cooler inflation, real incomes are less squeezed, which supports spending. -

Supportive Fiscal / Structural Policies

Recent reforms (e.g., GST rationalisation) and targeted fiscal measures may be starting to show a positive effect.

What This Means for Key Stakeholders

1. For Borrowers / Homebuyers

-

Stability in EMIs

With interest rates stable, borrowers don’t face immediate rate shock—good news for home loans or personal loans. -

Better buying confidence

A stable policy environment, combined with brighter growth, increases consumer confidence in making long-term purchases like property.

2. For Investors / Markets

-

Bond yields may soften

With inflation under control and growth expectations credible, bond markets may see downward pressure on yields. -

Equities get a positive push

The dovish pause plus better GDP outlook tends to be favorable for equities. The markets have already shown positive movement.

3. For Developers / Real Estate Sector

-

Cost pressure manageable

Since borrowing costs aren’t rising, product pricing pressure eases, making projects more financially viable. -

Demand support

With better growth and stable interest rates, consumer demand for homes may see renewed strength. -

Land & rates appreciation likely

Upgraded growth outlook may feed into land values and circle / benchmarking rates over time.

What Should You Do

-

Review existing loans/debt mix

If you have adjustable-rate debt, this pause gives breathing room. -

Consider investing (or upgrading) in property now

Stability and growth signals are a better backdrop for real estate investment. -

Monitor inflation & consumption indicators

If inflation resurges, the RBI may respond by reversing its stance. -

Watch for cues for December

Analysts and markets expect RBI may consider a 25 bps cut in December if the trajectory remains favorable.

Takeaways

Takeaways

The RBI’s decision to keep its repo rate unchanged at 5.50%, while simultaneously upgrading growth expectations to 6.8% and lowering inflation forecast to 2.6%, sends a clear message: policy support is being managed with caution but confidence. It reflects a central bank prepared to balance growth and price stability.

For homebuyers, borrowers, developers, and investors, this environment of “steady rates + brighter growth” provides a window of opportunity. If momentum holds, this could be the calm before a productive economic storm.

Visit Us: navimumbaihouses.com or Call on @ 8433959100

The post Repo Rate Unchanged, Economy Gets a Boost: RBI’s October 2025 Policy Explained appeared first on .