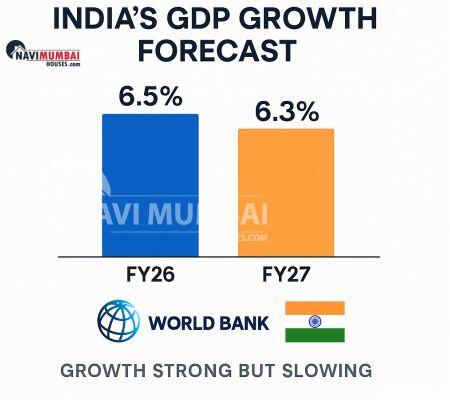

India’s growth engine is showing signs of deceleration. In its latest report, the World Bank has cut India’s GDP forecast for FY27 to 6.3%, down by 20 basis points (bps) from prior estimates — signaling caution ahead. Alongside, it has highlighted a pressing need for structural reforms to sustain momentum.

This revision comes amid global headwinds and rising trade tensions, especially with the imposition of nearly 50% tariffs by the U.S. on Indian goods — a move that could strain export sectors and overall growth.

What’s Behind the Downgrade?

A. External Risks & Trade Headwinds

One of the key reasons for the cut is the escalating trade tension. The U.S. has imposed steep tariffs, affecting key Indian export sectors. The World Bank’s report notes these as major drags on growth.

India is more insulated than many economies, given strong domestic demand, but the export sector is vulnerable — especially intermediate and manufacturing goods.

B. Good FY26 vs Slower FY27 Expectations

Interestingly, the Bank raised the FY26 estimate to 6.5% (from 6.3%) — citing stronger-than-expected performance in Q1 and domestic resilience.

But the FY27 cut suggests the Bank expects that tailwinds will fade and headwinds will grow. It signals less confidence in sustaining the 2025-26 momentum over a longer horizon.

C. Reform Urgency

The World Bank emphasises India’s need for faster implementation of reforms — in labor markets, trade policy, deregulation, business environment, and unlocking manufacturing potential.

Franziska Ohnsorge (Chief Economist, South Asia) notes evidence that authorities are keen on deregulation, and the “sense of urgency” is visible in committees formed to drive reform agendas.

Reforms already underway — like the GST rate cuts and direct tax revisions — are steps in that direction.

What This Means for India, Businesses & Investors

For India’s Economy

-

A FY27 growth of 6.3% is still respectable — but not comfortable. Slower growth constrains fiscal revenues, job creation, and investment plans.

-

If reforms don’t keep pace, India risks losing its brightness amid global slowdown.

For Businesses & Industry

-

Exporters (especially in manufacturing, textiles, intermediates) face increased pressure. Tariff barrier impacts may compress margins.

-

Businesses will demand policy clarity, ease of doing business, regulatory speed — uncertainty is costly.

-

Capital allocation may shift more toward sectors with insulating demand (domestic consumption, infrastructure, services).

For Investors & Markets

-

Growth downgrade can temper expectations around equity returns, corporate earnings in export-driven sectors, real estate demand in cyclical regions.

-

But strong reform signals and successful implementation could act as upside catalysts.

What to Watch & Do

-

Track reform implementation

Watch how quickly labor, trade, regulatory, and investment reforms are pushed from committees to ground action. -

Monitor export & trade performance

Especially for sectors hit by U.S. tariffs — see whether they adapt or contract. -

Watch corporate guidance and earnings

Companies will begin flagging margin pressure, demand slowdowns, or cost pass-through challenges. -

Watch government’s response

Whether the Union Budget, policy announcements, or relief measures align with the urgency flagged by the World Bank. -

Stay diversified

In volatile external settings, diversify sector exposure — avoid overconcentration in export- or trade-exposed names.

Takeaways

The World Bank’s revision — cutting India’s FY27 growth forecast to 6.3% while raising FY26 estimates — reflects a complex interplay of internal resilience and external challenge. While India’s strong domestic consumption and reform momentum offer buffers, the risk from global trade disruption, especially U.S. tariffs, is undeniable.

The signal is clear: growth is no longer assured, and the onus is now on policymakers to deliver reforms with speed and seriousness. For businesses and investors, adapting strategies to a modest growth environment — while staying alert for upside from successful reforms — will be critical.

If you like, I can also generate charts (growth forecast trends, export impact graphs) or a downloadable summary for your readers.

Visit Us: http://www.navimumbaihouses.com OR call us on @ 8433959100

The post 6.3% Is the New FY27 GDP Forecast — Why the World Bank Wants India to Act Fast appeared first on .