In a bold move toward financial inclusion, State Bank of India (SBI) is exploring the possibility of disbursing credit to farmers via UPI. The bank’s chairman, C. S. Setty, made this disclosure during his remarks at the Global Fintech Fest (GFF) 2025.

If implemented, this would be a transformative shift in how rural India accesses formal credit — treating borrowing as seamlessly as payments.

What Setty Said

-

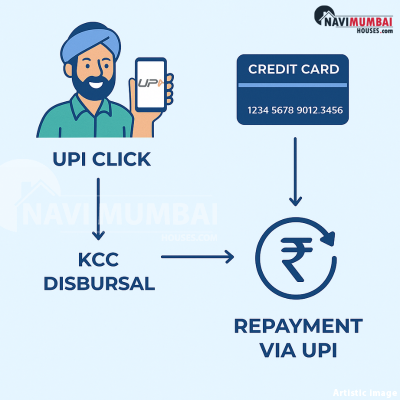

SBI is considering enabling Kisan Credit Card (KCC) disbursals through UPI to make credit more accessible, especially in rural and semi-urban areas.

-

The idea is to leverage UPI’s deep penetration and familiarity across India to push credit issuance to the “last mile.”

-

Setty pointed out that while disbursal is one side of the coin, collections and repayment management would be a real challenge in a UPI-based credit model.

-

He also raised the need to simplify KYC processes to support this model, noting that current KYC frameworks may not be agile enough for fast digital credit in rural areas.

In essence, SBI is envisioning a world where farmers can press a few buttons on their phone and receive KCC loans instantly via UPI channels — rather than going through multiple banking steps.

Why This Could Be a Game Changer

For Farmers / Rural India

-

Faster access to credit: No more delays waiting for bank visits, paperwork, or branch approvals.

-

Lower friction & cost: Digital interface reduces travel costs, form processing, and intermediary fees.

-

Greater inclusion: Farmers in remote areas who are UPI-enabled but underserved by branch networks can benefit.

-

Predictive / pre-approved models: With AI/data models, SBI could pre-approve micro-loans, making disbursals nearly instantaneous (for low-risk profiles).

For the Banking / Fintech Ecosystem

-

A new frontier of credit via payments rails: UPI is currently payments-only; extending it to credit would be a landmark shift.

-

Stronger data-driven underwriting: UPI behaviour, transaction history, and patterns could feed credit scoring models.

-

Partnerships & innovation: Fintechs, agritech firms, and rural platforms could piggyback on or co-develop with SBI.

-

Institutional advantage: SBI’s scale and trust give it a strong starting point; execution will matter.

Challenges & What SBI Must Solve

| Challenge | Why It Matters | Mitigation / What to Watch |

|---|---|---|

| Repayment / Collections | UPI-based credit may make tracking defaults and repayments harder, especially in rural areas. | Build auto-debit mandates, reminders, rollback mechanisms, and strong predictive risk modeling. |

| KYC / Customer Onboarding | Many rural customers have limited documented identity or bank history. | Use e-KYC, alternate verification, biometrics, or use govt identity systems (Aadhaar). |

| Risk & Credit Scoring | Lending to farmers is inherently cyclical (crop failure, rainfall). | Use weather data, crop yield data, satellite data, and actuarial models to reduce ticket size initially. |

| Regulatory & Legal Framework | UPI is a payments infrastructure; credit needs modifications, legal clarity, and regulatory backing. | Engage NPCI, RBI, and the finance ministry to adapt UPI rules, provide liability clarity, and define default handling. |

| Technology & Integration | Banks must integrate UPI credit disbursal, backend systems, reconciliation, and security. | Robust APIs, security audits, scalable architecture, fallback / failsafe systems. |

If these are addressed well, the UPI + KCC model could be vastly more efficient and inclusive than the current credit delivery in rural India.

What to Monitor

-

Pilot programs & rollout: Watch whether SBI launches pilots in select states or districts to test UPI-based KCC.

-

Regulatory adjustments: Notice whether RBI / NPCI issues guidelines allowing or framing “credit via UPI”.

-

KYC reforms: Monitoring announcements about simplified KYC, especially for small farmers.

-

Technology partnerships: Which fintechs or rural tech firms SBI team up with?

-

Risk metrics/performance: Early default rates, adoption metrics, repayment behaviour.

Conclusion

SBI’s exploration of UPI-based credit disbursal for farmers marks a bold step in reimagining how rural India accesses formal finance. If the bank successfully addresses repayment, KYC, regulatory, and tech challenges, this could democratize credit delivery — making lending as seamless as sending money.

However, the devil is in the details. The real test will be in pilot implementations, regulatory alignment, and risk control. For now, the idea is promising — but will it translate into real change?

Visit Us: http://www.navimumbaihouses.com Or Contact Us: tel:8433959100

The post Farmers to Get Loans on UPI? SBI Chief Says ‘It’s Being Explored’ appeared first on .