What the Report Says

-

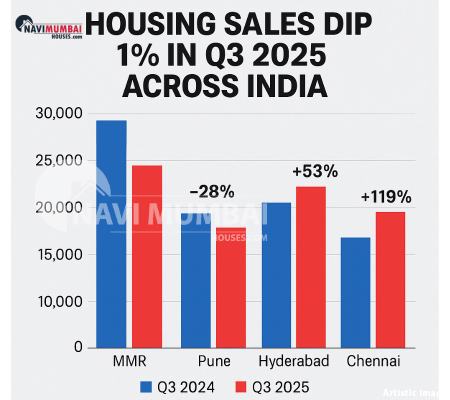

According to PropTiger’s Q3 2025 real estate report, India’s top housing markets saw a 1% year-on-year dip in volume, from ~96,544 units to ~95,547 units.

-

The value of transactions, however, rose strongly—by ~14%—to ₹1.52 lakh crore, signaling heavier weighting toward premium / higher-value properties.

-

Among markets, the fall was sharpest in the Mumbai Metropolitan Region (MMR) and Pune. In MMR, the drop was ~22.2% to ~23,334 units, while Pune saw ~27.9% contraction to ~12,990 units.

-

In contrast, some southern and eastern cities bucked the trend: Chennai sales jumped ~120.9%, Hyderabad ~52.7%, boosting overall averages.

This pattern reflects a shift: volume is under pressure, but value/premium segments show resilience.

Why MMR & Pune Fell More Sharply

Several interlinked factors help explain why two of the stronger markets faced the heaviest declines:

-

Affordability constraints: For many buyers, rising costs of land, materials, and rising interest rates squeeze budgets—peripheral projects in MMR / Pune often stretch affordability.

-

Overhang and saturation: Core and near-core zones may be saturated, pushing buyers toward suburbs—if those peripheries aren’t well connected, interest wanes.

-

Infrastructure delays/connectivity gaps: The peripheral projects often depend on upcoming road, metro, or utility projects. Delays or uncertainty dampen buyer confidence.

-

Shift to premium & high-end units: Buyers with capacity still prefer premium projects, leaving mid/affordable inventory lagging. The strong rise in transaction value suggests this.

-

Regional divergence: While the west (MMR / Pune) falters, southern/eastern cities with newer growth corridors and better delivery are picking up the slack.

What It Means for Stakeholders

| Stakeholder | Implication | What to Focus On |

|---|---|---|

| Developers in MMR / Pune | Need to re-evaluate project mix, reduce risk on mid/affordable housing | Focus on delivery, infrastructure tie-ups, and quality differentiation |

| Buyers / Investors | Better bargain opportunities in mid/peripheral zones, but must vet connectivity & developer execution | Investigate project status, approvals, road/metro alignment |

| Realty Analysts / Agencies | The narrative shifts from pure volume growth to selective, value-led recovery | Monitor premium segment trends, city-wise divergences |

| Authorities & Planners | To restore growth, must accelerate infrastructure in peripheral zones (roads, utilities, transit) | Align approvals, deliver connectivity, unblock infrastructure bottlenecks |

What to Watch in the Coming Quarters

-

Whether this dip is temporary (cyclical) or a structural slowdown in volume growth.

-

How new launches behave: are developers scaling back mid/affordable segments or focusing on premium?

-

Whether peripheral areas with stronger infrastructure (roads, metro) outperform core zones going forward.

-

Inventory levels and absorption rates, especially in lagging markets like Pune / MMR.

-

Policy interventions: incentives, stamp duty cuts, and affordable housing pushes to revive buyer demand.

Conclusion

Q3 2025’s housing sales dip of 1% is a modest correction in scale—but significant in direction. The sharp declines in MMR and Pune show that markets once considered strong are vulnerable when affordability, connectivity, and infrastructure do not keep pace.

However, rising transaction values and gains in southern cities suggest the stress is skewed: premium demand remains intact even as mid-segment volumes shrink. For anyone in real estate—developer, investor, or buyer—the message is: be selective, track city-level dynamics, and bet where infrastructure and execution back the promise.

Visit Us: Navimumbaihouses.com or Call Us @ 8433959100

The post Housing Sales Dip 1% in Q3 2025; MMR & Pune Hit Hardest—What’s Behind the Slump appeared first on .