Attention

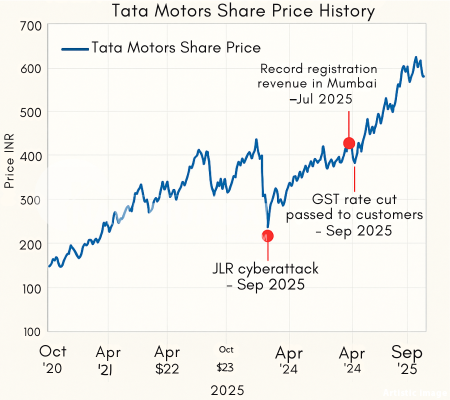

Tata Motors is one of India’s marquee auto stocks. Its share price movements reflect not just company performance, but broader trends in the auto sector, global supply chains, and macroeconomics. As of late 2025, the stock has seen volatility triggered by factors like the JLR (Jaguar Land Rover) cyber incident, GST changes, and shifts in investor sentiment.

Let’s walk through how the share has moved over months and years, what key inflection points have been, and what it means going forward.

Interest — Price History & Important Milestones

Recent & Current Price Snapshot

-

As of 29 September 2025, Tata Motors was trading around ₹674.40 / ₹674.70 on BSE in intraday trading.

-

Over the recent months, the 52-week trading range has been wide: from ₹535.75 to ₹996.95.

-

In early September, Tata Motors’ stock jumped ~3% to ~₹712 after the company decided to pass full GST reductions onto customers.

-

However, challenges have come from the Jaguar Land Rover (JLR) division, which faced a cyberattack, causing production halts and Moody’s downgrading the outlook to negative.

-

Data from Investing.com shows that over the period August 2025, daily highs and lows for Tata Motors ranged around ₹713 to ₹722 in parts of mid-September.

-

Analysts cite that Tata Motors is more of a cyclical play than a steady compounder, meaning it tends to swing with sectoral and macro trends.

-

The stock has also been sensitive to cost pressures, global demand for luxury cars (via JLR), and regulatory / tax changes in India.

Historical Movement & Patterns

-

Data from Investing.com shows that over the period August 2025, daily highs and lows for Tata Motors ranged around ₹713 to ₹722 in parts of mid-September.

-

Analysts cite that Tata Motors is more of a cyclical play than a steady compounder, meaning it tends to swing with sectoral and macro trends.

-

The stock has also been sensitive to cost pressures, global demand for luxury cars (via JLR), and regulatory / tax changes in India.

-

Key Inflection Events

-

JLR Cyberattack and Production Halt

This was a major shock. JLR contributes significantly to Tata Motors’ revenue, and the disruption, plus uncertainty, led to Moody’s downgrading Tata’s outlook. -

GST Rate Cuts / Industry Cost Benefit Transmission

Tata Motors’ announcement that it will pass on the GST benefit acted as a positive trigger for traders. -

Volatility from Market Sentiment & Cyclical Trends

Broader automotive sector cycles, interest rates, and supply chain disruptions influence daily and medium-term moves. Analysts often warn that Tata Motors is a “cyclical stock.” Valuation Adjustments & Circle / Ready Reckoner Changes

As revenue and profitability change, so do valuation expectations. Also, internal projections (capex, EV push, etc.) factor in heavily.

Desire — What Investors & Observers Should Note

From the price history and recent events, here are the takeaways:

-

Volatility is higher than average: Given exposure to JLR, global auto cycles, and supply chain risks, Tata Motors can swing significantly—both up and down.

-

Event-driven upside/downside: Good news (like tax benefits, EV adoption, revival at JLR) can produce sharp rallies. Conversely, shocks (like cyberattacks, global demand slumps) can trigger steep drops.

-

Value plays possible: When the stock falls due to external shocks, if fundamentals (book value, margin potential) are intact, it may present buying windows.

-

Watch EV / future direction: Tata’s push into EVs, cost controls, and global expansions (e.g., Iveco deal) will likely define its next leg.

-

Use technical & risk management tools: Stop losses, staggered entry, and a clear time horizon are crucial for a stock with cyclical swings.

Action — How to Use This in Your Portfolio

-

Segment your exposure

If you’re conservative, keep a smaller allocation; if aggressive, you can take higher exposure but manage sizing. -

Time entry near event corrections

After shocks (bad news), if fundamentals are not broken, dips may offer better entry points than buying at highs. -

Track key triggers

Keep a close eye on JLR recovery, EV strategy announcements, margin performance, and macro inputs (interest rates, raw material costs). -

Use technical analysis

Look for support & resistance zones, moving average breakouts, volume confirmation. -

Have an exit / stop plan

Given Tata Motors’ volatility, protect capital with defined stop levels or profit-taking zones.

Visit us : @91 8433959100 or www.navimumbaihouses.com

The post How Tata Motors’ Share Price Has Moved Over Time — Key Milestones & Insights appeared first on .