1. A Dramatic Turnaround

India Cements (ICL) is making a sharp comeback. Under its new majority control by UltraTech Cement, the company has:

-

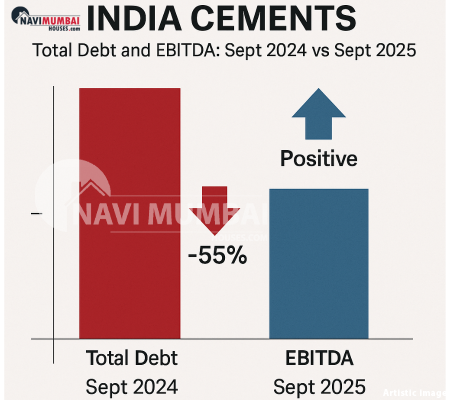

Slashed its debt by about 55% year-over-year.

-

Delivered a positive EBITDA in Q1 FY26 (₹92.31 crore) compared to a loss of ₹9.16 crore in the same period last year.

These are bold shifts for a company long seen as a laggard in the cement sector. But the key question for investors now is: Is this run sustainable?

2. What’s Driving the Revival

A. UltraTech’s Strategy & Leverage

-

The turnaround is not happening by accident — UltraTech’s acquisition triggered strategic interventions.

-

UltraTech used its stronger balance sheet to refinance debt at lower rates, bringing down interest costs.

-

Non-core asset sales also contributed to deleveraging.

B. Capex & Efficiency Focus

-

A planned ₹1,500 crore green power/efficiency capex aims to modernize aging plants, install Waste Heat Recovery Systems (WHRS), and reduce energy cost per ton.

-

The goal is to increase EBITDA per ton to ₹1,000/ton by FY28, from approximately ₹458/ton reported in Q1 FY26.

C. Volume Growth & Realizations

-

Domestic volume growth in Q1 FY26 was +11.6% YoY.

-

Realizations improved; however, ICL still earns slightly lower realizations compared to UltraTech-branded cement in overlapping markets.

3. What This Means (Opportunities & Expectations)

If the turnaround sticks, the implications are:

-

Valuation re-rating: From being a distressed/underperforming name to one of the sector’s growth stories.

-

Margin tailwinds: Lower interest cost + efficiency gains can free cash for new growth or further debt reduction.

-

Synergies/brand integration: As ICL’s output and volumes get absorbed into UltraTech’s network or brand channels, margins and realization may improve.

-

Better investor confidence: A successful revival will attract more institutional attention.

But, as with all comebacks, caveats apply.

4. Risks & Challenges That Could Derail the Recovery

| Risk / Challenge | Why It Matters | Mitigation / Watch For |

|---|---|---|

| Execution risk on capex | Delays or underperformance in plant modernization will harm projected cost cuts. | Monitor capex rollout, plant uptime, and efficiency metrics. |

| Input cost volatility | The cement industry is sensitive to energy, fuel, and raw materials. Rising costs may eat into margins. | Watch coal, power tariffs, and logistics cost trends. |

| Market/demand softness | In South India, especially, demand has been volatile. Weak demand may pressure pricing. | Monitor regional demand growth, order backlog. |

| Brand transition risk | Transitioning from the ICL / Coromandel brand to the UltraTech brand in markets may face resistance. | Track shift in volumes/revenue under UltraTech branding. |

| Contingent liabilities | Any hidden liabilities, litigation, or environmental costs may surface. | Review the balance sheet footnotes and liabilities. |

5. What Investors / Stakeholders Should Watch

-

Quarterly EBITDA per ton metrics

Whether the ₹1,000/ton target is on path or slipping. -

Capex progress & efficiency gains

Are plants coming online, WHRS systems installed, and energy consumption measuring lower? -

Debt maturity/refinancing schedule

Even though debt is down, how much is due, at what cost, and whether new debt is at favorable terms. -

Brand/revenue mix shift

How much of the ICL volume moves under UltraTech’s brand or distribution, and whether the realization differential closes. -

Regional demand trends

Especially in South Indian states, government capex, infrastructure demand, housing/realty construction demand. -

Compare vs peers

Benchmark ICL’s margins, leverage, and growth vs other cement companies to see whether its structural properties are improving.

Takeaway

India Cements’ journey from high leverage and losses to a cleaner balance sheet and positive EBITDA is a remarkable turnaround, catalyzed by UltraTech’s buy-in and strategic restructuring. The stage is set for a revival, but the path is not guaranteed.

Sustainability of this run will depend heavily onthe execution of efficiency upgrades, control over input costs, demand stability, and the successful integration into UltraTech’s network. If ICL can hit its targets (especially ₹1,000/ton EBITDA) without hiccups, it could transform from a distressed asset to a mid-cap poster child of turnaround in the cement industry.

But remember: comebacks are fragile. For cautious investors, monitoring execution and quarterly performance will be just as important as optimism.

Visit us: http://www.navimumbaihouses.com Or Contact us: @ 8433959100

The post India Cements 2025: From Debt Burden to EBITDA Breakthrough — Sustainable? appeared first on .