1. Market Context & Setup

The Indian equity market entered Friday with caution. The Nifty 50 slipped for a second straight session, and importantly fell below its 21-day exponential moving average (21-EMA) — a technical trigger signalling short-term weakness.

Amid this weak backdrop, analysts see select buying opportunities in fundamentally sound stocks that are technically poised for short-term upticks.

2. The Five Stock Picks & Their Targets

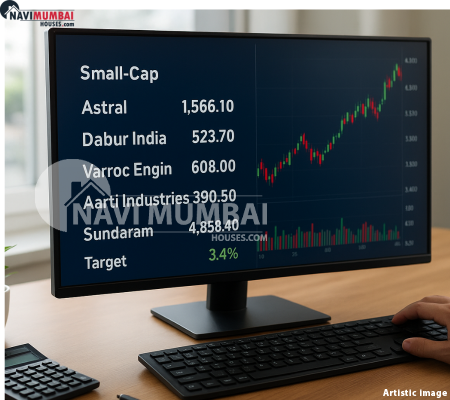

According to the trading guide from Economic Times, here are the five stocks recommended for Friday trading, with their entry reference and upside targets:

| Stock | Entry Range | Upside Target |

|---|---|---|

| Astral Ltd | ≈ ₹1,566.10 | ~ 3.4% |

| Dabur India | ≈ ₹523.70 | Up to ~ 9% |

| Varroc Engineering | ≈ ₹608.00 | ~ 5% |

| Aarti Industries | ≈ ₹390.50 | ~ 2.4% |

| Sundaram Finance | ≈ ₹4,858.40 | Up to ~ 8% |

These stocks are chosen on technical cues — breakouts, support levels, volume upticks — rather than purely fundamental stories. The idea: trading for a short-term move (2–3 weeks) rather than a long-term investment.

3. Why These Stocks Attract Picks Now

-

Astral: A leading name in plumbing & water-management solutions. Excellent technical structure, recent consolidation resolved, favourable industry tailwinds.

-

Dabur India: An FMCG heavyweight with stable business and brand strength. Among the five, the highest upside (up to ~9%) indicates a favourable risk‐reward for a short-term bounce.

-

Varroc Engineering: Automotive ancillary exposure. With auto recovery anticipated, it stands to capture momentum; technically, it shows breakout potential.

-

Aarti Industries: Specialty chemicals company. Small upside target shows conservative pick but low risk; technically ready for a move.

-

Sundaram Finance: A high‐quality NBFC with a strong asset base; the largest base price but offering solid ~8% upside for short‐term trades.

4. Risk & Strategy Considerations

While the upside might appear modest (2.4% to 9%), short-term trades require discipline. Key considerations:

-

Stop-loss discipline: If the stock invalidates the breakout or key support levels, exit quickly.

-

Time horizon: These are not long-term holds; recommended for a 2–3 week timeframe.

-

Market context matters: The overall market is under pressure. If broader indices continue to slide, even technically poised stocks may underperform.

-

Volatility & liquidity: Small-caps carry higher volatility; ensure position size aligns with risk tolerance.

5. How To Execute

-

Enter near the reference entry range or after confirmation of breakout with volume.

-

Place a stop-loss just below the recent support or below the breakout candle.

-

Define target (as above) and consider booking partial profit once the target is hit.

-

Monitor market conditions: if Nifty continues to lose ground, reduce exposure or opt for more defensive trades.

Conclusion

In a cautiously trading market, short-term technical setups offer interesting opportunities — provided you pick quality stocks, use disciplined entry/exit, and keep risk in check. The five stocks — Astral, Dabur, Varroc, Aarti Industries and Sundaram Finance — represent niche plays with decent upside for this week.

But let’s be clear: this is trading, not investing. If your time-horizon is years, you might prefer stocks with stronger fundamentals and deeper research. For traders, though, this list gives a starting point — and a possible 3–9% move over the next few weeks.

Visit Us: Navimumbaihouses.com or Call Us @ 8433959100

The post Market Trading Guide: Buy Astral, Dabur & 3 More Small-Cap Stocks for Potential 9% Upside appeared first on .