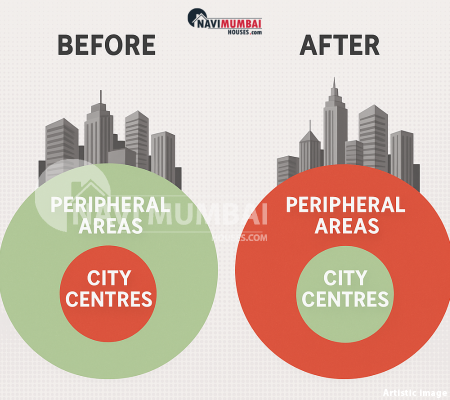

Historically, Gurugram, South Delhi, Central Delhi, Noida (closer sectors) formed the premium zones of NCR’s real estate. Buyers paid for proximity, social infrastructure, prestige, and access to central business districts. Because of this, city centre sectors used to dominate launches, demand, and price appreciation.

Developers concentrated in well-known nodes, and peripheral areas were considered secondary or speculative bets.

The Rise of Peripheral Micro-Markets

In recent years, the narrative is shifting. Peripheral areas such as Dwarka Expressway, Southern Peripheral Road (SPR, Gurgaon), Greater Noida West, Yamuna Expressway, New Gurugram, Siddharth Vihar, and Faridabad are seeing faster growth, increased launches, and higher sales momentum.

Some key indicators:

-

Developers are launching more units in peripheral corridors rather than in saturated city centres.

-

Property prices along the SPR corridor in Gurgaon have surged ~125% in the past five years.

-

Land and housing in corridors connected to UER-2, Dwarka Expressway, and expansion into Outer Delhi / Sonipat / Kundli are expected to see 15–20 % growth over the next few years.

-

Infrastructure projects (metro extensions, expressways, regional rapid transit, airport plans) are fueling confidence in these micro-markets.

Thus, the center of gravity is shifting outward.

Why the Periphery Is Winning: Key Drivers

| Factor | What’s Changing | Impact |

|---|---|---|

| Connectivity & Infrastructure | New expressways, metro lines, UER extensions, better roads linking periphery to core | Reduces commute, makes peripheral zones viable for daily travel |

| Land & Development Leverage | Peripheral zones offer larger plots, easier approvals, lower input costs | Developers and buyers can get more value per rupee |

| Better Livability & Amenities | New townships with landscaped open spaces, gated layouts, social infrastructure (schools, hospitals) | Improves quality of life, especially for families |

| Supply Saturation / Price Ceiling in Core | City centres are saturated, and land becomes costlier | Buyers push outward for affordable alternatives |

| Speculation & Investment Mindset | Investors betting on appreciation in emerging corridors | Drives early demand and small-scale development |

Implications for Stakeholders

-

Buyers / Investors: The peripheral zones may generate higher capital appreciation and better living space. But risk (connectivity, execution) remains larger.

-

Developers: Shifting focus toward micro-markets; need to invest in infrastructure, partnerships with authorities, phasing.

-

Local Authorities / Governments: Maintenance of roads, infrastructure rollout, approvals, and quality control become critical to sustain growth.

-

Real Estate Market Dynamics: Expect increased competition, land acquisition, clustering of services, geopattern shifts.

What to Watch / Red Flags

-

Whether the promised infrastructure (expressways, metro, roads) is delivered on time.

-

Quality and rate of execution: developers must deliver vs just announcing.

-

Oversupply risk in peripheral zones if investor demand falls short.

-

Distance & travel friction for early movers before infrastructure upgrades.

-

Regulatory and environmental clearances in periphery (green zones, buffer areas).

The post NCR’s New Growth Story: Peripheral Areas Outpace City Centres in Real Estate appeared first on .